Some of the links in this post are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. All opinions remain my own.

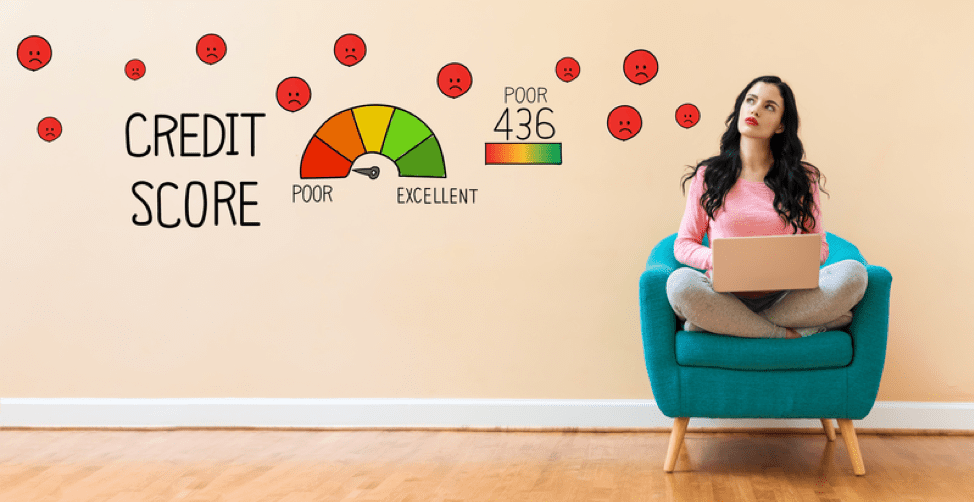

A high credit score is a huge source of stress, especially when you find that your bills are too high and begin to take away from other important expenses. It’s more than understandable why you might have used credit cards to make ends meet; when you’re in desperate need of money, a credit card is practically handing you a lump sum of cash for free. But we all know that credit cards aren’t really free, and paying them back can quickly grow tiresome and feel unending. Fixing your credit score ultimately saves you money everywhere in your life. These three reasons may serve as a good motivator for you to start getting serious about resolving your credit card debt.

Lowering Your Interest Rate

Having a low credit score means that getting low-interest rates on new cards or a mortgage will be next to impossible. Your credit score is one of the biggest factors that impact your mortgage rate, and a low score may make buying a house almost impossible even if you can afford it with your salary. People with high-interest rates pay thousands of dollars more on their home mortgages and other loans. Fixing your score can improve your interest rates and make monthly payments much more affordable.

Decreasing Living Expenses

Your credit score affects your life in surprising ways; everyday expenses and general living costs can come at a higher price for those with bad credit. Higher repayments mean you have less money to afford essentials, and you can easily find yourself stuck paying extra fees or being declined important things just because of your credit score. Cell phone carriers check your credit before deciding whether or not they’ll offer you a contract; banks may decline to let you open a new checking account if you have too much debt. Car insurance rates are much higher if you have poor credit. In many cases, a landlord may require you to pay additional cash deposits before offering you a lease. Improving your credit score could save you money by resulting in lower rent, mortgage, and insurance costs.

Car Insurance

Your credit score can drastically impact how much you pay for car insurance. Rates and premiums vary by provider, but you will rarely be able to find a good deal on coverage if you have a bad credit history. Drivers with poor credit scores spend up to 50 percent more on their auto insurance premiums. A high premium may cause you to skimp on services and additional coverages, so fixing your score will allow you to have better car insurance for less.

Fixing your credit starts with getting on a payment schedule you can afford. Contact your credit card providers and discuss your repayment options. You may also want to speak with a financial advisor about consolidating your credit card debt, which can make it much easier to manage.