Some of the links in this post are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. All opinions remain my own.

Financial literacy is a crucial life skill that everyone should possess, regardless of age. However, it is especially important to start teaching money management to young children. By instilling good financial habits and knowledge at an early age, children can develop a strong foundation for making wise financial decisions in the future.

Starting young has numerous benefits. Firstly, young children have a natural curiosity and eagerness to learn. They are like sponges, absorbing information and skills quickly. By introducing money management concepts early on, children can grasp the basic principles and build upon them as they grow older.

Additionally, teaching money management to young children helps them develop a sense of responsibility and independence. They learn the value of money and how to make informed choices about spending, saving, and budgeting. These skills will serve them well throughout their lives, enabling them to navigate the complex world of personal finance with confidence.

Age-Appropriate Money Management Lessons for Young Children

Teaching money management to young children should be tailored to their age and developmental stage. Here are some age-appropriate lessons for different age groups:

1. Preschoolers: Identifying coins and bills

For preschoolers, the focus should be on introducing the concept of money and helping them recognize different coins and bills. This can be done through fun activities such as sorting and matching games or pretend play with toy cash registers.

2. Elementary schoolers: Budgeting and saving

Elementary school-aged children can start learning about budgeting and saving. Teach them how to set goals and allocate their allowance or earnings towards different categories such as spending, saving, and giving. Encourage them to save for something they really want and help them track their progress.

3. Middle schoolers: Understanding credit and debt

As children enter middle school, they can begin to understand more complex financial concepts such as credit and debt. Teach them about the importance of responsible borrowing and the consequences of overspending. Introduce the concept of interest and how it can affect their financial decisions.

The Benefits of Teaching Money Management to Young Children

Teaching money management to young children has numerous benefits that extend beyond their childhood years. Here are some of the key advantages:

1. Improved financial decision-making skills

By learning about money management from a young age, children develop critical thinking skills and the ability to make informed financial decisions. They learn to weigh the pros and cons, consider alternatives, and evaluate the long-term consequences of their choices.

2. Increased confidence and independence

Understanding money and how to manage it gives children a sense of control over their own lives. They become more confident in making financial decisions and taking responsibility for their own financial well-being. This independence will serve them well as they grow older and face more complex financial situations.

3. Reduced financial stress in adulthood

Financial stress is a common problem for many adults, often stemming from poor money management skills or lack of financial literacy. By teaching children how to manage money effectively, we can help them avoid common pitfalls and develop healthy financial habits. This can lead to reduced financial stress in adulthood and a greater sense of financial security.

How to Teach Money Management Skills to Young Children

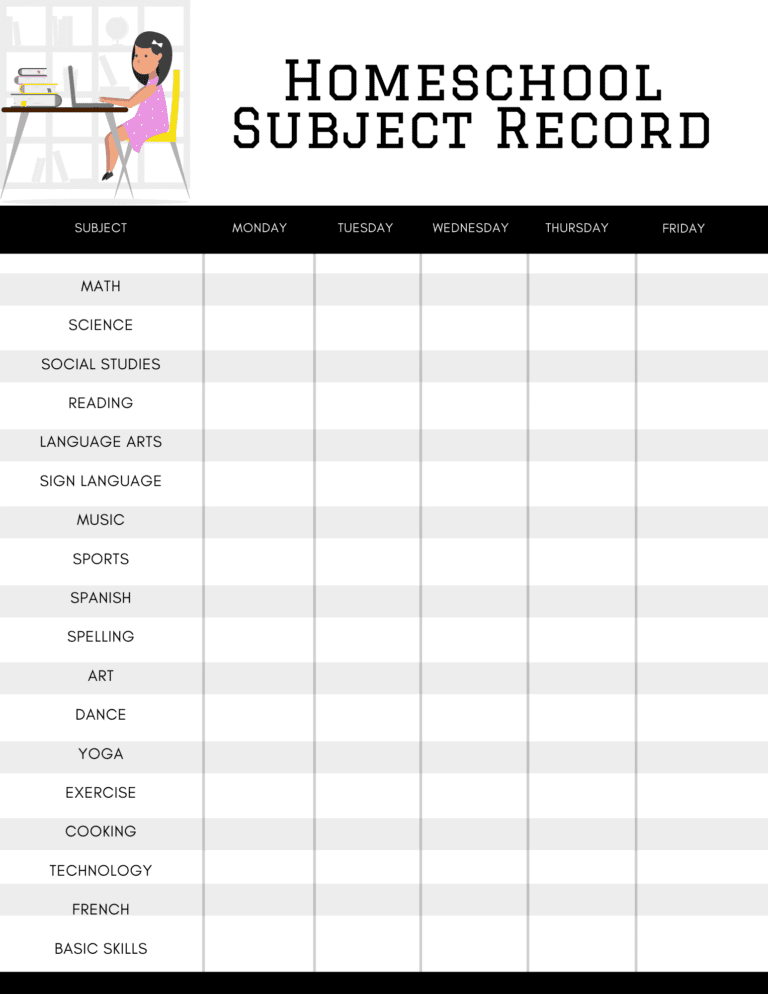

| Age Group | Key Concepts | Activities |

|---|---|---|

| 3-5 years old | Identifying coins and bills, understanding the value of money, distinguishing between needs and wants | Playing store, sorting coins and bills, creating a savings jar |

| 6-8 years old | Counting money, making change, budgeting, setting financial goals | Playing board games that involve money, creating a budget for a pretend family, setting savings goals |

| 9-12 years old | Understanding interest, comparing prices, making financial decisions, using a bank account | Researching and comparing prices for a big purchase, opening a savings account, creating a spending plan |

Teaching money management skills to young children doesn’t have to be boring or overwhelming. Here are some strategies to make it engaging and effective:

1. Use real-life examples

Children learn best through real-life examples and hands-on experiences. Take advantage of everyday situations to teach them about money management. For example, involve them in grocery shopping and show them how to compare prices or make a budget for a family outing.

2. Make it fun and interactive

Learning about money doesn’t have to be dull. Use games, puzzles, and role-playing activities to make it fun and engaging. For example, you can create a pretend store at home and let your child play the role of the cashier or customer. This will help them understand the value of money and practice basic math skills.

3. Encourage questions and discussions

Encourage your child to ask questions and express their thoughts and opinions about money. Engage in open and honest discussions about financial topics, such as saving, spending, and giving. This will help them develop critical thinking skills and a deeper understanding of money management concepts.

Setting Financial Goals with Young Children

Setting financial goals is an important part of money management. It helps children develop a sense of purpose and motivation to save and make wise financial decisions. Here are some tips for setting financial goals with young children:

1. Short-term vs. long-term goals

Teach children the difference between short-term and long-term goals. Short-term goals are things they want to achieve in the near future, such as buying a toy or going on a trip. Long-term goals are things they want to achieve over a longer period, such as saving for college or a car.

2. Making goals achievable and measurable

Help children set realistic and achievable goals. Break down larger goals into smaller, more manageable steps. For example, if they want to save $100 for a new video game, help them set a weekly or monthly savings target. This will make the goal more attainable and measurable.

3. Celebrating progress and success

Celebrate your child’s progress and success when they reach their financial goals. This could be as simple as praising their efforts or rewarding them with a small treat or privilege. Celebrating their achievements will motivate them to continue practicing good money management habits.

The Importance of Saving and Budgeting for Young Children

Saving and budgeting are fundamental money management skills that children should learn from an early age. Here’s why they are important:

1. Teaching the value of delayed gratification

Saving teaches children the value of delayed gratification. They learn that by postponing immediate wants, they can achieve greater rewards in the future. This skill is essential for making wise financial decisions and avoiding impulsive spending.

2. Creating a budget and sticking to it

Budgeting helps children understand the importance of managing their money wisely. It teaches them to prioritize their spending, allocate their resources effectively, and make informed choices about how to use their money. By sticking to a budget, children learn to live within their means and avoid unnecessary debt.

3. Saving for emergencies and future expenses

By saving money, children develop a safety net for emergencies and unexpected expenses. They learn the importance of having financial security and being prepared for the future. This will help them develop a habit of saving and avoid financial stress in adulthood.

Teaching Young Children About the Value of Money

Understanding the value of money is an important lesson for young children. Here are some key concepts to teach them:

1. Understanding the difference between needs and wants

Help children differentiate between needs and wants. Teach them that needs are essential things we require to survive, such as food, shelter, and clothing. Wants, on the other hand, are things we desire but can live without. By understanding this distinction, children can make more informed purchasing decisions.

2. Learning to make informed purchasing decisions

Teach children how to make informed purchasing decisions by comparing prices, reading product reviews, and considering alternatives. Encourage them to think critically about whether a purchase is worth the cost and whether it aligns with their values and goals.

3. Recognizing the value of hard work and earning money

Help children understand that money is earned through hard work and effort. Teach them about different ways people earn money, such as through jobs or entrepreneurship. This will instill a sense of responsibility and work ethic in them, as well as an appreciation for the value of money.

Using Technology to Teach Money Management to Young Children

Technology can be a valuable tool for teaching money management to young children. Here are some ways to incorporate technology into their financial education:

1. Educational apps and games

There are numerous educational apps and games available that teach children about money management in a fun and interactive way. These apps often include features such as budgeting simulations, goal-setting tools, and quizzes to test their knowledge.

2. Online resources and tools

There are many online resources and tools that provide valuable information and guidance on money management for children. Websites such as Money as You Grow and Practical Money Skills offer age-appropriate lessons, activities, and worksheets that can be used to supplement their learning.

3. Virtual banking and budgeting simulations

Some banks offer virtual banking platforms specifically designed for children. These platforms allow children to practice managing their money, making deposits and withdrawals, and tracking their spending. They can also set savings goals and monitor their progress over time.

Encouraging Entrepreneurship and Financial Responsibility in Young Children

Encouraging entrepreneurship and financial responsibility in young children can help them develop important skills and attitudes towards money. Here are some ways to foster these qualities:

1. Starting a small business or side hustle

Encourage your child to start a small business or side hustle, such as a lemonade stand or pet-sitting service. This will teach them about the value of hard work, responsibility, and earning money. It will also help them develop entrepreneurial skills such as marketing, budgeting, and customer service.

2. Learning about investing and compound interest

Introduce the concept of investing to your child by explaining how money can grow over time through compound interest. Teach them about different investment options, such as stocks or bonds, and the potential risks and rewards associated with each. This will help them understand the importance of long-term financial planning.

3. Practicing responsible borrowing and lending

Teach your child about responsible borrowing and lending. Explain the concept of loans, interest rates, and the importance of repaying debts on time. Encourage them to save up for larger purchases instead of relying on credit. This will help them develop a healthy attitude towards debt and avoid financial pitfalls in the future.

The Long-Term Impact of Teaching Money Management to Young Children

Teaching money management to young children has a profound and lasting impact on their financial well-being. By starting early, children can develop good financial habits, make informed decisions, and achieve their financial goals. They become empowered and confident in managing their own finances, leading to a greater sense of control and security in adulthood.

Furthermore, teaching money management to young children increases the likelihood of achieving long-term financial goals. By instilling good financial habits from an early age, children are more likely to save for emergencies, invest for the future, and avoid unnecessary debt. This sets them up for a lifetime of financial success and stability.

Ultimately, teaching money management to young children equips them with essential life skills that go beyond dollars and cents. It teaches them responsibility, independence, critical thinking, and delayed gratification. These skills will serve them well in all aspects of life, enabling them to make wise decisions and achieve their goals.

FAQs

What is the importance of teaching young children about money?

Teaching young children about money is important because it helps them develop financial literacy skills that they will use throughout their lives. It also helps them understand the value of money and how to manage it responsibly.

At what age should parents start teaching their children about money?

Parents can start teaching their children about money as early as age three or four. At this age, children can begin to understand basic concepts such as counting and identifying coins and bills.

What are some ways parents can teach their children about money?

Parents can teach their children about money by giving them an allowance, encouraging them to save money, involving them in household budgeting, and discussing financial decisions with them.

How can parents make learning about money fun for their children?

Parents can make learning about money fun for their children by playing games that involve money, such as Monopoly or The Game of Life. They can also use real-life scenarios, such as grocery shopping or going to the bank, to teach their children about money.

What are some common mistakes parents make when teaching their children about money?

Some common mistakes parents make when teaching their children about money include not setting clear expectations or boundaries, not being consistent with allowances or consequences, and not involving their children in financial decision-making.